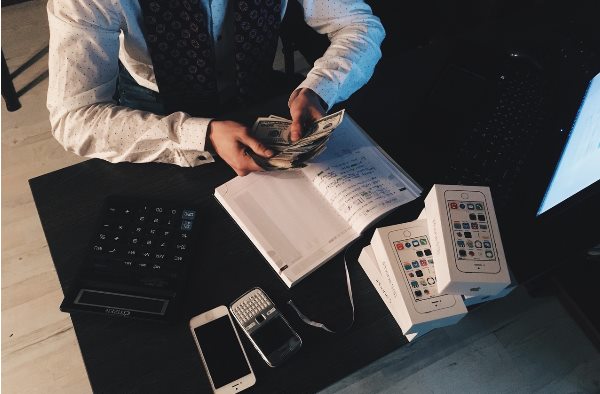

Are you a nightmare when it comes to money? Do you keep your receipts and plan your spending or do you go wild with your credit card and enjoy splashing out all the time?

Spending without thinking might seem fun at the time, but we bet you hit the end of the month and start sweating over what you have to pay! If this sounds like you then we think you need to gather up the reins and stop!

If you ask your financial advisor the first thing he is going to tell you is that you need to set yourself a budget. A budget done correctly is the most accurate tool for analysing your finances imaginable. It answers two fundamental questions

Do I spend more than I earn?

An instinctive assessment is easy - if you're eating up your savings or building up debts, you're likely to be overspending. Before you can solve this, it's important to get an accurate idea of the size and scale of the problem.

This is nothing new - Dickens' Mr Micawber laid out the principle pretty well in the 19th century:

Major overspending can lead to a debt spiral and severe problems, that's why the Budget Planners are all designed to definitively answer this issue and give you a real assessment of your finances.

What can I afford to spend?

Once you know where you're spending, you can start to alter and prioritise what you do with your money to enable you to stick within your means.

While the budget planners include tools to allow you to work out how to prioritise within your means, the real difficulty is sticking to it. The Piggybank Technique is designed to help you do just that.

What's different about this budgeting technique?

Is it often said "In debt? Do a budget!", "Skint? Draw up a budget!", "Wife run off with the milkman? BUDGET!" While budgeting is seen as a panacea, unfortunately, most budgets are bunkum.

The main problem is that because they concentrate on a typical month, they massively underestimate your real spend, as this misses enormous costs such as Christmas, summer holidays, new sofas or even changing car every five years.

Broad categories like "motoring" make it too easy to forget the small expenditures that add up. Instead, it needs to be MOTs, new tyres, petrol, insurance, breakdown cover and more.

Using this way of budgeting should help you become more organised with your finances and lead you to a healthier and less stressful future.

It doesn't mean you can't have fun, take the kids on adventures or splash out on that new pair of shoes, it just enables you to know what you are going to have in your bank at the end of the month if you do splash the cash.

Hopefully, it will encourage you to save too. Giving you a better pool of money to dip into when something goes wrong in your life.

Get budgeting! It will help your future!

| < Prev | Next > |

|---|