An Australian first study by Macquarie University of the country’s book publishing industry reveals considerable innovation in response to the digital disruption that has resulted in a significant drop in onshore book sales.

The study uncovers the strategies being used by Australian publishers by analysing findings from interviews with 25 senior Australian publishers of various sizes, across trade, education, scholarly and literary sectors.

Dr Jan Zwar, researcher at Macquarie University’s Faculty of Business and Economics, said, “As a mid-size industry, Australian publishers have been forced to work harder in order to compete globally and deal with major changes that have been occurring across the industry.”

“We saw publishers develop defensive strategies to entrants such as Google, Apple and Amazon, for example the development of direct to consumer print and ebook sales. In some cases, such as Harlequin, the sale of ebooks is an extension of its postal mail order services to readers.”

“While other publishers employed opportunistic strategies that leveraged digital technology, such as open access publishing and the use of metadata, apps and social media for promotion.”

“For instance, Momentum was set up in Australia by Pan Macmillian to experiment with epublishing, ebook pricing and digital sales channels. Kylie Scott, who is now a New York Times best-selling author, was discovered through Momentum’s open submission process.”

“Other strategies aimed to open up new, different markets and to create new business models, for instance new types of royalty agreements between publishers and authors and moves to subscription models,” added Dr Zwar.

The report also looks at the structural changes within the industry and the impact this is having on book sales.

For instance, Big W is now believed to be the single biggest book retailer in Australia. The online retailer Booktopia, purchased Bookworld in 2015 and is now the dominant Australian-based online retailer, with an estimated market share of six to seven per cent.

On education book publishing, Dr Zwar commented, “Education publishing is arguably undergoing more radical transformation than trade publishing because it is also affected by disruption in the education sector. In additional to technology, education publishing is affected by government policies to improve education and employment outcomes as well as financial constraints.”

The research was the second part of a larger project that looked at Australia’s book industry, which included a report on Australian authors that was released in October 2015.

More information on both reports can be found at: http://goto.mq.edu.au/book-industry

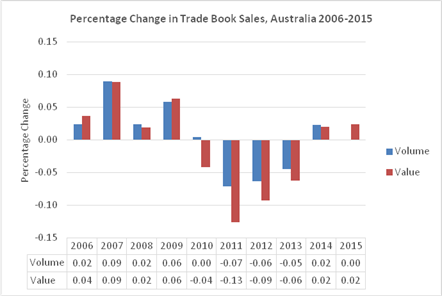

Figure 1. Percentage change in Australian trade book sales 2006-2015. Figures are rounded and are not adjusted for inflation. Source: Nielsen BookScan (AP3 Panel) 2016

· Offshore sales are estimated at 250 million dollars per year but there are no reliable figures. It is likely to vary according to fluctuations in the exchange rate. Australian publishers are developing strategies to gain prominence for their books in online retail stores such as temporary price reductions to drive titles up bestseller lists.

· The average selling price of books in Australia has gone down from a peak of $19.90 in 2009 to $17.35 in 2015 as publishers have responded to price competition from overseas retailers.

· Fiction titles which have the exceptional backing of large publishers may achieve sales of 50,000 – 100,000 copies or more while specialist, academic titles and books of poetry may sell in the low hundreds.

· Currently, approximately 33-36 per cent of trade books sold in Australia are written by Australian authors, according to industry estimates.

· Turnover in bricks and mortar retail outlets in Australia was estimated at over $900 million in 2013-2014.|

Channel |

Value of turnover |

Comments |

|

Bookchains |

38% |

Includes Dymocks, QBD, Booktopia and Koorong plus other bookseller chains. |

|

Discount and Department Stores (DDS) |

28% |

Eg., Big W, Kmart and Target; Myer and David Jones. |

|

Independent bookstores |

27% |

Independent bookstores are particularly important for launching debut Australian titles. |

|

Other |

7% |

|

At 41.4 per cent, educational books have the largest market share.

About Macquarie University Faculty of Business and Economics

Macquarie University’s Faculty of Business and Economics offers undergraduate and postgraduate courses in addition to strong academic research in the fields of accounting and finance, actuarial studies, business, economics, marketing and management. http://www.businessandeconomics.mq.edu.au/

Genre Publishers

· Michelle Laforest, Harlequin Enterprises

· Joel Naoum, Momentum

· Alison Green, Pantera Press

Multinationals

· Larissa Edwards, Simon & Schuster

· Justin Ractliffe and Louise Sherwin-Stark, Hachette

Large Australian Publishers

· Jim Demetriou, Allen and Unwin

· Julie Pinkham, Hardie Grant Books

Specialist Literary Publishers

· Alice Grundy, Seizure

· Simon Groth, if:book Australia

· Susan Hawthorne, Spinifex Press

· John Knight and Linsay Knight, Pitt Street Poetry

· Jacinda Woodhead, Overland

Scholarly Publishers

· Lorena Kanellopoulos, ANU Press

· Nathan Hollier, Monash University Publishing

· Paul Ashton, Re.press

Community-based Publishers

· John Harms, Malarkey (publisher of The Footy Alamanc)

· Victoria Ryle, Kids Own Publishing

· Rachel Bin Salleh, Magabala Books

Education Publishers

· David Barnett, Pearson Australia

· Chris Gray, Wiley

· David O’Brien and Paul Petrulis, Cengage Learning

· Peter Van Noorden, Oxford University Press

Recent Ventures

· Jodie Blight, Hello Table

· Lou Johnson, The Author People

· Chris Stephen and Anna Tuyl, Accessible Publishing Systems

Overview of the Australian book publishing industry

· After several years of decline, 2015 was the first year in which onshore trade book sales increased. Trade sales in 2015 were worth approximately $979 million, which is 2.4 per cent higher in value compared to the previous year to date period and education sales were approximately $410 million.

· The chart below shows the turbulence of recent years. Major factors include the upswings created by blockbusters including Harry Potter, Twilight, Fifty Shades of Grey and most recently, adult colouring books. Downswings include the absence of blockbusters compared to the previous year, the take-up of offshore sales to Amazon, Amazon’s Book Depository and other overseas retailers, and the closure of REDGroup Retail in 2011 which was associated with a 20 per cent contraction in trade book sales.

| < Prev | Next > |

|---|