24 March 2015. Australians buy a lot of cars every day but do they get the best finance deal possible?

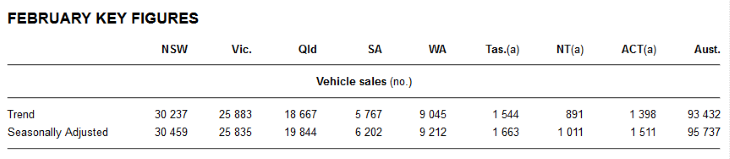

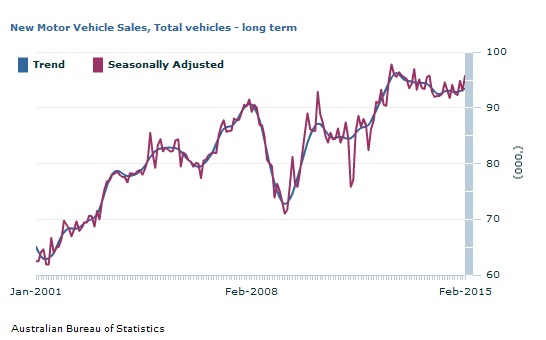

Last month, 93,432 new cars were sold in Australia.* That is just new cars. Thousands more second hand cars were purchased by Australian families, teenagers looking for their first car or even Australian businesses looking for good looking reliable budget transport.

Every one of those new and used cars had a price. The cost to buy 93,432 new cars at an average of $30,000.00 would have been $2,802,960,000.00.

Not all Australian car buyers have $30,000.00 in the bank so they use car finance to fund the acquisition. While people often haggle over the price of new and used cars they fail to compare and save when they are looking for car finance.

If that $2,802,960,000.00 was funded at 10% that is a lot of interest to be paid for years for a car loan. That is $280,296,000.00 in interest every month. If the car finance was just 5% it is $140,148,000.00 a month and that is why it would be easier to pay. A lower interest rate will save money for every car buyer.

Everyone who buys a car with finance must make the monthly interest or lease fee as low as possible but many Australians are easily led and just sign up for the finance they are offered by dealers or finance companies.

"Everyone should consult a car finance expert before signing a contract to buy a car or finance a car."

Should I use car finance offered by a dealer?

One of the big mistakes car buyers make is to sign up for the finance that the car dealer offers. It might be easy to say "Yes" to car finance funded or arranged by the dealer, especially if the buyer thinks they have struck a good deal on the price. The truth is that car dealers often make more money on finance interest and commissions or charges than they do on car sales. Then there is the profit they make on car part warranties that they sell in huge numbers.

A key issue that every car loan seeker needs to be aware of is that a car dealer does not have to look after the buyer's interests. The car yard exists to make money from car sales, finance deals and warranty sales. To do that they have to extract as much money as possible from every buyer. No chance of the best car finance deal there!

Buyers must compare and save. That is why every car buyer: young people, families, businesses and retirees should look for their finance either before they look for a car to buy or having found a car, to not sign up for dealer finance, factory finance, zero percent interest, bank finance or finance company finance until they have spoken to independent car finance experts.

There are a lot of finance options in Australia and the every day average Australian has not had the opportunity to study or know the finance industry like a car finance professional.

Car buyers have not had time to build industry connections with lenders, to network at conferences and to share information on what offers are available.

Hunting around for the possible deal in a car loan is vital. Savvy Car Finance is one business that knows the Australian finance industry intimately and consultants can tell car buyers all around Australia what is on offer on any day.

Buyers can talk to a finance expert or go online or even call in to become fully informed about what car finance options exist BEFORE choosing a car or taking a car loan.

For those buyers who have found a new or used car that they want to buy, they can speak to Savvy car finance consultants before they sign up for dealer offered finance.

Remember, people need to save on the price of a car, the monthly interest payable on a car loan and the insurance premium. That is how to put a car on the road as cheaply as possible.

Should I take the finance offered by car makers?

Sometimes a car dealer will suggest to customers that factory finance is a good way to fund the purchase of a new or used car. It is best to compare and save because a car maker offers finance to sell a car and to help their car dealers to make sales. The cost of factory finance may not be as low as a car finance expert can offer any car buyer.

Beware of adverse terms and conditions in car loan contracts.

Car finance consultants also know the impact of the fine print in car loan contracts. Get expert advice before signing any car loan contract.

You need to be informed about things like repossession thresholds, penalty interest, residual value, insurance requirements, what accessories can be fitted to a car, early repayment penalties and many other terms and conditions.

There is no need to take any deal. Everything can be negotiated when you have expert car loan advice from people who know the car finance market.

* ABS - http://www.abs.gov.au/ausstats/abs@.nsf/mf/9314.0

Saving on the cost of car insurance is important to every Australian motorist. We will look at Car Insurance another time.

Tags:

Car Finance

Chattel Mortgage

Hire Purchase

Car Lease

Novated Leasing

Bad Credit Car Loans