February 2, 2016: As the Reserve Bank of Australia continues their wait and see approach, lenders have taken matters into their own hands, offering sweeteners and rock-bottom rates to ‘ideal borrowers’ with sizeable deposits.

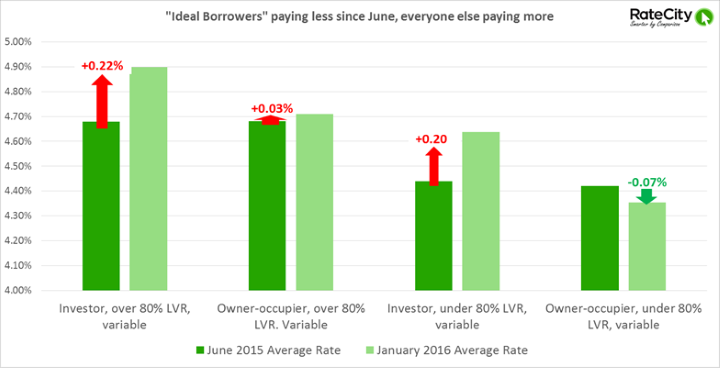

Data from RateCity.com.au shows that owner occupiers with at least a 20 per cent deposit are enjoying, on average, rates that are up to 0.55 percentage points lower than other mortgage holders.

Sally Tindall, money editor at RateCity.com.au, said that deposits were becoming an increasingly important factor for the banks when deciding whether to offer a person a home loan.

“The five lowest variable rates on our site are only for people with deposits of 30 per cent or more,” she said.

“For example, the highest loan-to-value (LVR) requirement is from Mortgage House who are asking for a deposit of 60 per cent, if you want access to a rate of 3.89 per cent.

“Risk-based pricing is an important factor for the banks and rightly so. It’s crucial for them to be lending to stable borrowers, and they are right to reward them with lower rates,” she said.

But the banks are equally if not more attracted to the lure of new customers. RateCity.com.au data shows that in the last four weeks, around 20 lenders have dropped their lowest variable rates, if customers are bringing them new business.

“These special discounts are great news for someone looking to enter the property market but next to useless for an existing loyal customer,” she said.

“If that’s happening to you, call them on it. Check what your bank is offering new customers and ask for that same low rate.

“The number of lenders offering rates under 4 per cent has more than doubled in the past few months, to over 20, so there’s plenty of competition to switch to if you need.

For a list of some of the lowest home loan rates on the market click here.