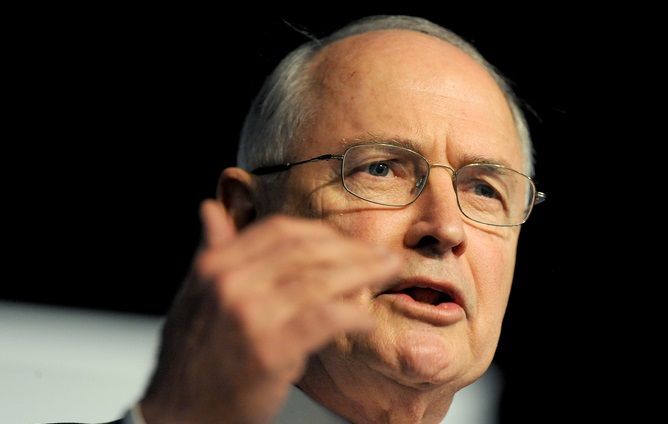

Ross Garnaut was the architect of the Labor government’s carbon pricing scheme, which looks likely to be scrapped this week despite last week’s brinkmanship in the Senate.

The Conversation asked Professor Garnaut where this leaves Australia on the world stage, whether we have any tools left to cut greenhouse emissions, and why a government with a much-touted budget crisis on its hands has decided to forego several billion dollars in carbon tax revenues.

You largely designed Australia’s carbon price. How does it feel to see several years’ work now being undone?

For me it’s probably the biggest thing I’ve done in a busy life for more than seven years. Yes it’s sad, but what I feel doesn’t matter. What matters is that Australia – for a while, at least – will now be a drag on the international effort to combat this serious problem, and that makes it a bit less likely that the world will deal with the matter satisfactorily. That’s the substantive issue at stake.

Globally, economic opinion seems to be coalescing around your view that market mechanisms are the way to handle climate change. Will other countries now see Australia as having a backward attitude, and treat it accordingly?

There’s no doubt that Australia is out of step. First of all, out of step for not dealing more strongly with the issue of climate change – you can reduce emissions and play your full part in an international effort without a market-based mechanism, it’s just that the alternatives are more expensive, more difficult, and less certain to deliver good results than an emissions trading scheme or broadly based carbon pricing in other forms.

But we don’t have alternative mechanisms for achieving similar results; it’s doubtful that we will meet, on the government’s current policies, the targets that we have notified to the international community. Those targets are not just minus 5% by 2020 – it’s minus 5%, minus 15%, or minus 25% depending on what other countries are doing. That’s our formal commitment to the UN Framework Convention on Climate Change, and it’s unlikely that without further policy developments we’ll get there. The Climate Change Authority, which has been established under Australian law to provide advice on this matter, said the appropriate target is minus 19%.

By choosing to dismantle carbon pricing we’re choosing to dismantle the low-cost way of getting to whatever carbon targets we have, and we’re choosing to stand outside an increasing tendency of the rest of the world to go in this direction. But I reiterate that other countries, or indeed Australia, could reach appropriate targets without an emissions trading scheme – the case for an emissions trading scheme is an economic one, it’s the low-cost way and most certain way of getting there.

Do you have any confidence that the Direct Action plan is the right way to go and can be made to work without being incredibly expensive?

Not as articulated in the government’s White Paper. Something called direct action could work; one could even say that what the US is doing is a form of muscular direct action. But that’s not what was described to us in the White Paper.

You could only be sure that an Emissions Reduction Fund of the kind described by the government is going to reduce emissions at all if you had baselines in place for all enterprises in the economy, and penalties in place for breach of those baselines. Otherwise, the ERF could buy emissions reductions in one plant (say, a coal-based plant in the Latrobe Valley), and then even the same company could simply expand coal-based electricity generation from other plants. So the scheme as outlined could not deliver with certainty any emissions reductions at all.

The government has made a point of saying that the scheme will not be punitive. How can a scheme that doesn’t penalise people for excessive emissions succeed at all?

Well I don’t think you can be certain of it succeeding at all in reducing emissions without penalties. I’ve got a lot of respect for (independent) Senator (Nick) Xenophon’s role in public policy in Australia – he’s been a person who’s kept an open mind about direct action but his tentative, conditional support for the government has always been based on appropriate baselines being put in place. It’s a mistake to conflate direct action, in the absence of baselines and penalties, with what we’ve been told will happen.

The carbon tax will be gone long before direct action becomes law. Does Australia have any tools left to cut emissions in the meantime?

The retention of the Renewable Energy Target exactly as it is – that’s what the Palmer United Party agreed to and the Labor Party also supports, so if they hold by those positions there’ll be no change.

Besides that, the Clean Energy Finance Corporation and Australian Rewable Energy Agency can give us substantial emissions reduction in the electricity sector – the largest single source of emissions in Australia. And electricity is even more important than it sounds, because if you decarbonise electricity you’re well on the way to decarbonising transport through subsequent electrification of transport.

So certainly keeping those three institutions in place, together with keeping the Climate Change Authority, which if properly funded has the capacity to undertake research and analysis and give transparent public advice on what our targets should be – that all amounts to much more than nothing. But of course if carbon pricing were part of the mix, we’d get similar reductions in the electricity sector at somewhat lower cost.

The problem is in the large part of the economy that doesn’t relate to electricity or energy. Some of those other parts of the economy are rapidly growing sources of emissions, most importantly fugitive emissions from expansion of LNG [liquified natural gas] liquefaction and export, and from coalmines. And those fugitive emissions could grow to an extent that swamps the reductions in emissions in electricity.

Clive Palmer could save the framework of emissions trading _ although he wants a price of zero. AAP Image/Lukas Coch

Clive Palmer could save the framework of emissions trading _ although he wants a price of zero. AAP Image/Lukas Coch

What did you make of Clive Palmer’s call for a zero-priced emissions trading scheme? Constructive suggestion or cynical ploy?

Time frames are important – we and the world need to be doing things right now; it’s a rather urgent problem. But there are nevertheless substantial advantages in keeping the infrastructure of an emissions trading scheme. If we remove the architecture, the institutional arrangements, it would take quite a while to build it up again. So the great advantage of keeping the infrastructure even with a low price is that when our political elites are ready to again join the international effort, we could ramp it up relatively quickly.

You have suggested moving to an interim low price of 40 cents per tonne. But surely the carbon market won’t work to cut pollution if the credits are too cheap?

Well it won’t work in the same way as the existing arrangements; it’s inferior to them. I was making that suggestion in the circumstance in which the alternative is to get rid of the architecture completely.

The advantage of my proposal is that it keeps the infrastructure in place, but also it allows us to formally meet our international obligations, because as far as the international community is concerned, as far as the United Nations is concerned, as far as our partners in this great endeavour are concerned, the Clean Development Mechanism credits are valid ways to meet obligations to reduce emissions. So if the appropriate target is minus 19%, as the Climate Change Authority says it is, then we would be meeting our international obligations if a large part of that was met buy buying international credits.

The disadvantage for Australia of going down that route is that we delay the process of the structural transformation that has to take place in this country, and which I’ve no doubt will sooner or later take place. And if we compress that adjustment into a short period of time later on, then we’ll increase the cost and the difficulty of that adjustment.

Tony Abbott’s pledge to scrap the carbon tax will make Treasurer Joe Hockey’s job a lot harder. AAP Image/Alan Porritt

Tony Abbott’s pledge to scrap the carbon tax will make Treasurer Joe Hockey’s job a lot harder. AAP Image/Alan Porritt

Repealing the carbon tax will cost billions of dollars in lost budget revenue. Do you think there will come a point where the government decides it would rather have the money?

In the end it will depend on the government’s judgement about the relative importance of various commitments. It has made a commitment to put Australia in a stronger budget position, and that happens to be a position that I support. I would like to see more, not less, budget consolidation in the risky world that we’ll have to live through in the years ahead.

But this budget, as it turns out – with the removal of carbon pricing, with other budget deficit-increasing commitments of the government, and with the changes in the Senate – is actually an expansionary budget. It adds more to the deficit. We’ll have a bigger deficit over the four-year period than we would have had if the previous government’s policies had remained exactly as they were. Some people will rue that outcome, but I wouldn’t be sure that budget reform is as important as some of the political objectives of the government.

Author

| < Prev | Next > |

|---|